What Are The Documents Required For Opening An Account With Zerodha?

To trade (in stocks, commodities, currency) or invest (in stocks, mutual funds) with Zerodha, you need to open a demat account.

Zerodha offers three types of accounts:

Trading account

Demat account

Commodity account

Also, Zerodha offers 2-in-1 accounts (trading and demat) with smooth transactions. The Zerodha account opening fee is Rs. 200 for a trading account and Rs. 0 for a demat account.

If your mobile number is linked to your Aadhaar, you can open a Zerodha account online. The following Zerodha account opening documents are required to open an online account:

The self-attested copy of PAN with the signature of the applicant.

A scanned copy of the signature is required. Sign with a black or blue ballpoint or ink pen. It is not permitted to use markers or sketch pens.

A masked Aadhaar must be submitted, i.e. the first eight digits must be blacked out. Please only show the last four digits.

Aadhaar-linked mobile number.

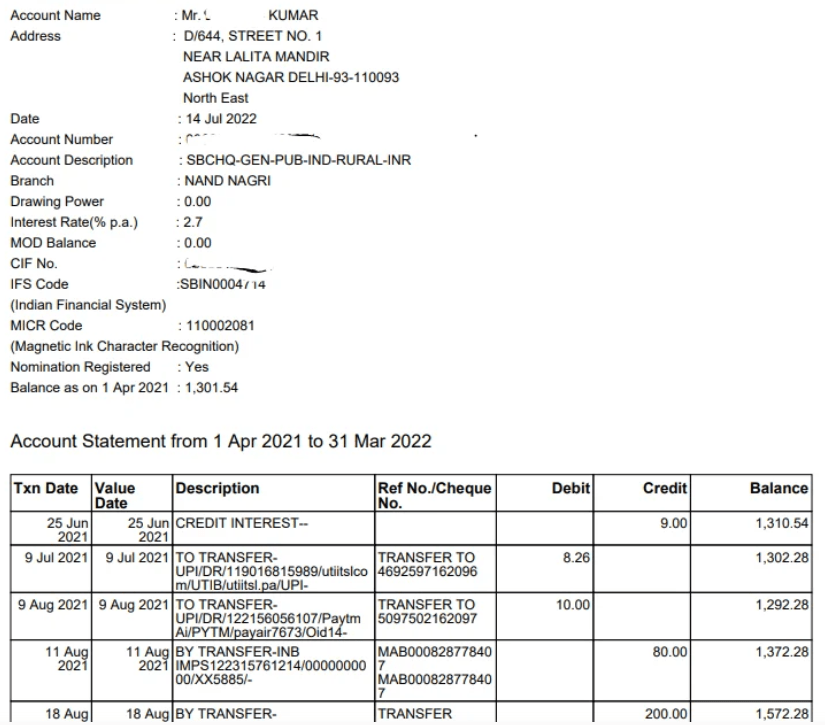

Bank proof in the name of the client. There are several options for bank proof: a personalised cancelled check with the name on it, a bank statement, or a copy of the bank passbook with the account number, logo, seal, MICR, and IFSC.

Proof of income is required if a client wishes to trade F&O. One of the following income proofs can be provided:

Bank statement with the bank seal and logo for the last six months with an average balance of more than Rs.10,000.

A salary slip with a gross monthly income exceeding Rs.15,000.

ITR acknowledgement with a gross annual income of more than Rs.1,20,000.

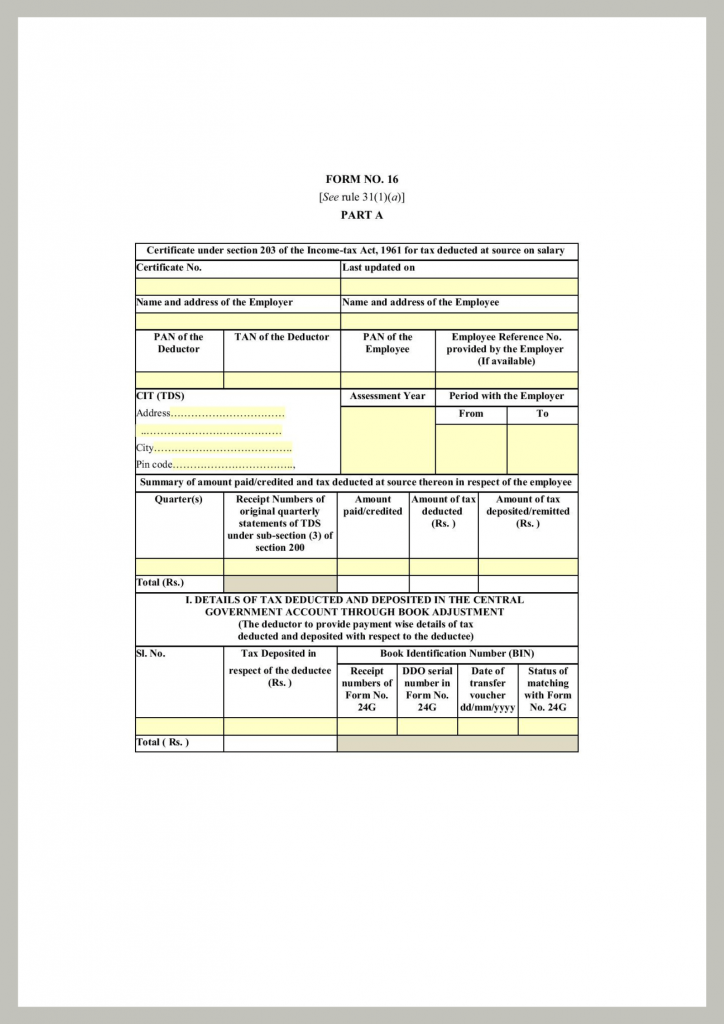

Form 16 with gross annual income above Rs.1,20,000.

Certificate of net worth exceeding Rs.10,00,000

A detailed statement of demat holdings with a current value exceeding Rs.10,000.

With these Zerodha demat account opening documents, you can open and manage your Zerodha demat account seamlessly.