How to Place a Stop Loss Order in Angel One?

- Last Updated: 19 Dec, 2023

- Value Broking

- Mins

- 2.2K

You can place a stop-loss order on Angel One's mobile app by following these steps:

Steps to place a stop-loss order on Angel One

| Steps | Description |

| 1 | Choose the stock and click 'Buy' or 'Sell' |

| 2 | Go to 'Smart Orders' and click 'Stop Loss Order' |

| 3 | Fill in the 'Quantity' and 'Trigger price' |

| 4 | Put a stop-loss limit order or a stop-loss market order |

| 5 | Put the 'Trigger Price' |

| 6 | Put in the 'Limit Price' to place a stop-loss order |

How Do I Place a Stop-Loss Order on Angel One?

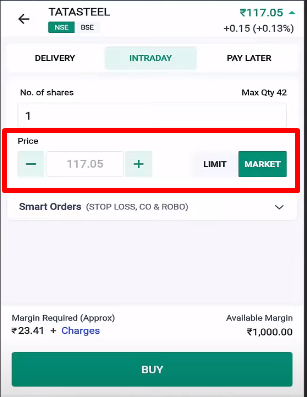

Step 1: Choose the stock and click 'Buy' or 'Sell.'

Step 2: Go to 'Smart Orders' and click 'Stop Loss Order.'

Step 3: Fill in the 'Quantity' and 'Trigger price.'

Step 4: Put a stop-loss limit order or a stop-loss market order by selecting Limit or Market.

Step 5: Put the 'Trigger Price' in.

Step 6: Put in the 'Limit Price' if you're placing a stop-loss order.

Step 7: Your stop-loss order will be placed when you click 'BUY' or 'SELL'.

Conclusion

Stop-loss orders are an integral part of the trading and risk management mechanism. Using them can protect you from much higher losses in the market when it faces a much higher level of losses. With a stop-loss order, you can limit your losses by placing an order when a certain price is reached. An automatic stop-loss order is executed as soon as the security price reaches the trigger price.