How to do Square off on Sharekhan?

A key aspect that makes it possible for traders to efficiently manage their positions and reduce potential losses in the stock market is Square Off by Sharekhan. The specifics of how to execute a Square Off with Sharekhan and its importance in trading will be covered in this article.

Steps to do Square off by Sharekhan

| Steps | Description |

| 1 | Learning Sharekhan Square off |

| 2 | Implementation of square off |

| 3 | Manual Initiation of square off |

| 4 | Risk Management |

| 5 | Comfort of in Mind |

| 6 | Immediate Action |

| 7 | Compliance |

| 8 | Reduced Emotion |

How do I Square off using Sharekhan

Step 1: Learning Sharekhan Square Off

When the specified stop loss price is achieved, Sharekhan’s Square Off feature is intended to shut out a trader’s open positions automatically. As a safety net, this feature aids traders in limiting their losses if the market moves against their bets.

Step 2: Implementation of Sharekhan Square Off

Traders can specify a stop-loss price when they set up their positions with Sharekhan. As a trigger, this stop-loss price is used. Sharekhan’s algorithm will automatically square off the position if the market price reaches or exceeds this level. As a result, prospective losses are minimized because the trader’s position will be closed out at the current market price.

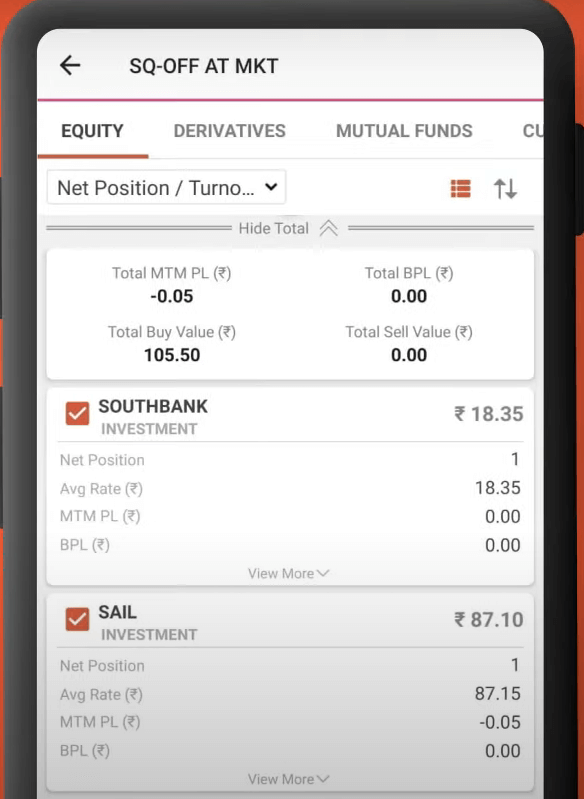

Step 3: Manual Initiation of Square Off

Apart from the automatic trigger, Sharekhan also allows traders to manually initiate a Square Off before 3:11 PM or such time as specified by Sharekhan. This flexibility gives traders more control over their positions and allows them to respond quickly to changing market conditions or news events.

Step 4: Risk management

It is important because it is a helpful instrument in this area. If the market goes negatively, it makes sure that traders do not suffer substantial losses.

Step 5: Comfort of In Mind

Being aware that your positions will automatically be squared off when the stop loss is reached might bring about peace of mind. Without continually watching the market, traders can concentrate on other elements of their trading approach.

Step 6: Immediate Action

Manually starting a Square Off can be quite important in markets that move quickly. It enables traders to react quickly to abrupt price changes or unforeseen news developments.

Step 7: Compliance

Sharekhan’s Square Off feature also helps traders comply with regulatory requirements. It ensures that positions are closed out when necessary, preventing traders from holding losing positions indefinitely.

Step 8: Reduced Emotion

Emotion can cloud judgment in trading. Sharekhan Square Off removes the emotional aspect of decision-making, as positions are closed automatically based on predefined parameters.

Conclusion

Sharekhan Square Off is an essential tool for traders to control risk and safeguard their wealth. A trader can move more confidently and systematically through the stock market by setting stop-loss levels and making use of the option to square off holdings manually. This function is consistent with Sharekhan’s dedication to providing traders with the resources and services they need to make wise trading choices.